Mutual fund investments are always subjected to market risk, but what if the country’s policies had made it too risky to invest? Know every detail about China’s mutual fund backlash.

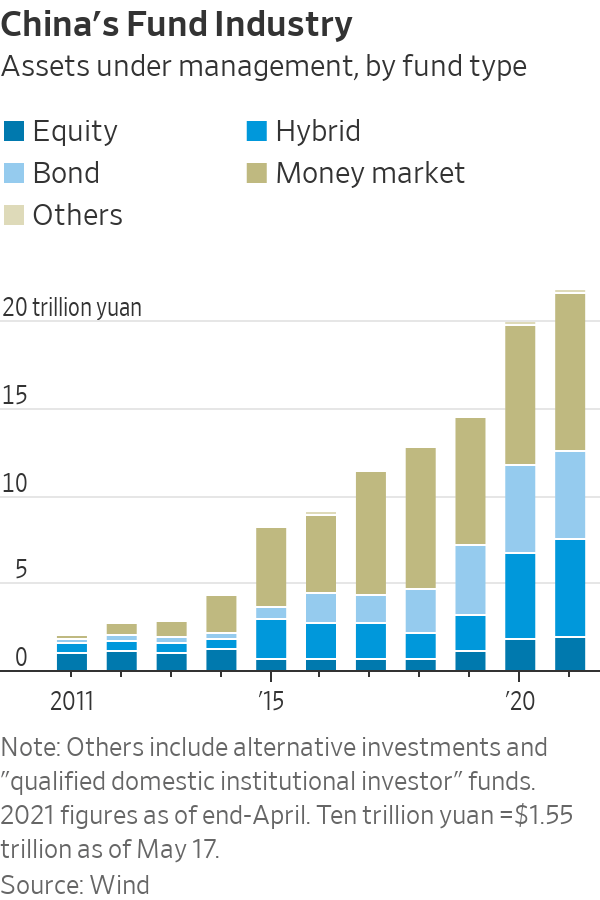

The $3.4 trillion Chinese mutual fund market grew 2.3% in 2020, making China the only country to report growth during the pandemic.

The market crash has brought down numerous star managers who went from rags to riches during the boom into the deepest pit within a year. The loss and fury of investors have changed the future of many popular agents into nightmares.

A recent study on the funds sold on Alipay found that 90% of the investors who held funds for a year or more had gained while 70% of the people who invested money in the last three months had lost their capital.

China had only given the opportunity for foreign companies to procure a majority stake in local mutual fund markets, resulting in a market boom that left Wall Street scraping for investors.

The pandemic had lured several financially insecure youngsters to invest in these mutual funds through assuring social media influencers, portfolio manager profiles online, and the easy-to-invest, low-cost apps that had widely advertised themselves.

The main reason for the crash was China’s new foreign investment policy that led to panic selling, and withdrawal of funds created a huge impact.

The policies are being reconsidered, and the market has been slowly rising again as per Wind.